Buying cryptocurrency for the first time can be both exciting and intimidating. Many newcomers are unsure where to start, how to avoid scams, and which platforms are reliable. The process involves creating a secure account, verifying your identity, funding it, and finally making your first purchase. Unlike traditional banking, crypto transactions are irreversible, which makes security and choosing the right platform critical. Market volatility also requires beginners to plan carefully and invest only what they can afford to lose. Understanding fees, different coin options, and storage methods are essential parts of the journey. This guide explains each step with practical details and examples to make your first crypto purchase smooth and safe, reports G.business.

Choosing a reliable cryptocurrency exchange

Before you buy any digital coin, the first step is selecting a reliable exchange. Popular global platforms include Coinbase, Binance, Kraken, and Bitstamp, while European residents often use Bitpanda or eToro for convenience with SEPA transfers. A good exchange should be licensed, provide transparent fee structures, and support strong security measures like two-factor authentication. Beginners should compare user interfaces, support options, and availability of mobile apps. Keep in mind that some exchanges limit services depending on the country of residence. Trading volume and liquidity also matter, as they ensure faster order execution without large price fluctuations.

Key factors to compare when selecting an exchange:

- Regulation and licenses

- Supported fiat currencies (EUR, USD, GBP)

- Transaction fees and deposit/withdrawal options

- Range of available cryptocurrencies

- Security features like cold storage and two-factor authentication

- Customer support availability

Registering and verifying your account

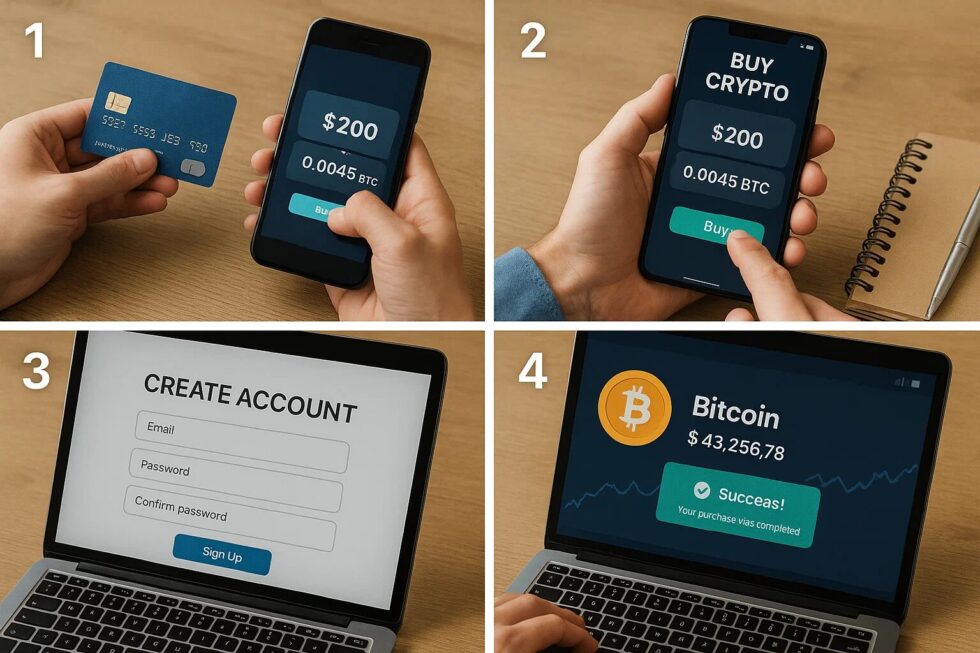

Once you have selected an exchange, the next step is registration. Creating an account usually requires an email address, a secure password, and acceptance of the platform’s terms. Most regulated exchanges require KYC (Know Your Customer) verification to comply with financial regulations. This process typically includes uploading a passport or ID card, proof of address (such as a utility bill), and sometimes a selfie for identity confirmation. Verification can take from a few minutes to 48 hours depending on the platform and volume of new users.

Documents commonly required for verification:

- Valid passport or government-issued ID

- Proof of residence (utility bill, rental contract, bank statement)

- Sometimes additional verification such as a selfie with ID

Funding your account

After your account is verified, you need to deposit funds. Most exchanges accept bank transfers, credit or debit cards, and increasingly, PayPal or Sofort in Europe. Bank transfers usually take 1–2 business days but often have the lowest fees. Credit cards allow instant deposits but may charge higher transaction costs. It is also important to check whether your bank has restrictions on transfers to crypto platforms. For small first purchases, card payments can be more convenient, but larger amounts are usually better sent via bank transfer.

Deposit methods and their characteristics:

| Method | Processing time | Fees (approx.) | Suitable for |

|---|---|---|---|

| Bank transfer | 1–2 business days | Low (0–1.5%) | Large deposits |

| Credit card | Instant | Medium (1.5–4%) | Small quick purchases |

| PayPal/Sofort | Instant–few hrs | Medium (1–3%) | Flexible payments |

Selecting your first cryptocurrency

The most common choice for beginners is Bitcoin (BTC), as it is the most established and widely accepted coin. Ethereum (ETH) is another popular option because it powers smart contracts and decentralized applications. However, exchanges also offer thousands of alternative coins, known as altcoins. Beginners should be cautious, as many altcoins are highly volatile or speculative. A good strategy is to start with a small purchase of a top-tier cryptocurrency, build experience, and diversify later. It is also important to follow market capitalization and liquidity rankings on platforms like CoinMarketCap or CoinGecko before deciding.

Most purchased cryptocurrencies by beginners:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Binance Coin (BNB)

- Cardano (ADA)

Making your first purchase

Buying crypto is as simple as placing an order on the exchange. You can choose between market orders (instant purchase at the current price) or limit orders (buy at a specific price you set). Market orders are easier for beginners but may result in slightly higher costs during volatile times. After confirming the amount in fiat currency (e.g., €100), the exchange automatically calculates how much cryptocurrency you will receive. Once the transaction is complete, the coins appear in your exchange wallet.

Types of orders for beginners:

- Market order: buys instantly at the current price

- Limit order: executes only when the price reaches your chosen level

- Stop order: useful for protecting against sudden price drops

Storing your cryptocurrency securely

After purchasing, the most critical step is storage. Keeping funds on an exchange is risky, as platforms can be hacked or freeze accounts. Beginners should consider transferring coins to a personal wallet. There are two main types: hot wallets (software or mobile apps) and cold wallets (hardware devices such as Ledger Nano X or Trezor). Hot wallets are convenient for frequent use but less secure. Cold wallets provide maximum safety since they store coins offline. Many investors use both—keeping small amounts for daily transactions in a hot wallet and larger holdings in a hardware wallet.

Wallet types and features:

| Wallet Type | Examples | Security level | Suitable for |

|---|---|---|---|

| Hot wallet | Trust Wallet, MetaMask | Medium | Daily transactions |

| Cold wallet | Ledger, Trezor | Very high | Long-term storage |

| Exchange wallet | Built-in wallet on Coinbase, Binance | Low–medium | Short-term storage |

Understanding transaction fees and hidden costs

Every crypto transaction involves fees. Exchanges charge trading fees, usually between 0.1% and 0.5% of the trade volume. Deposit and withdrawal fees vary depending on the payment method and currency. Additionally, blockchain networks themselves require “gas fees” or transaction fees, especially on Ethereum, where costs can rise during busy times. Beginners should always check the fee structure of the chosen platform to avoid surprises. Comparing fees before buying can save significant amounts over time.

Common fee categories to check:

- Trading fee per transaction

- Deposit and withdrawal charges

- Blockchain network fees (gas)

- Spread between buy and sell prices

Comparing fees on major exchanges

One of the most overlooked aspects when buying cryptocurrency for the first time is the cost of trading. Even small differences in fees can add up significantly over time, especially for active buyers. The biggest exchanges—Coinbase, Binance, and Kraken—each have their own fee models.

Trading fees on leading exchanges (as of 2025):

| Exchange | Trading fees (spot) | Deposit fees | Withdrawal fees | Notes |

|---|---|---|---|---|

| Coinbase | 0.5% per trade (buy/sell) + spread | Bank transfer: free, Card: up to 3.99% | Crypto withdrawal: network fee | Very beginner-friendly but more expensive |

| Binance | 0.1% per trade (can drop to 0.075% with BNB) | Bank transfer: free, Card: 1.8% | Withdrawal varies by coin (e.g. BTC ~0.0002 BTC) | Best liquidity and lowest spot fees |

| Kraken | 0.16% maker / 0.26% taker | Bank transfer: free, Card: up to 3.75% + €0.25 | Crypto withdrawal: varies (BTC ~0.00015 BTC) | Strong regulatory compliance and security |

These numbers show why many beginners start with Coinbase for simplicity but later switch to Binance or Kraken for lower long-term fees. Binance is generally the cheapest for frequent traders, while Kraken offers a balance of strong security and reasonable costs.

Practical tips for first-time buyers

Starting small is often the best way to gain confidence. Experts recommend beginning with an amount you are willing to lose, such as €50–€100, to learn the process. Always enable two-factor authentication, use strong unique passwords, and beware of phishing emails. Diversifying investments over time and setting realistic expectations helps manage risk. Cryptocurrency is not a quick path to wealth, but a long-term strategy can be rewarding.

Checklist for safe crypto purchases:

- Start with small investments

- Enable two-factor authentication

- Use reputable exchanges only

- Store long-term holdings in a hardware wallet

- Stay updated on regulations and tax obligations

5 mistakes beginners should avoid

- Investing more than you can afford to lose – many newcomers put in large sums too quickly and panic when prices drop.

- Leaving all coins on the exchange – platforms can be hacked; always move long-term holdings to a hardware wallet.

- Ignoring fees and hidden costs – high card fees or network fees can eat into profits without noticing.

- Falling for hype and scams – avoid “guaranteed profit” offers or unregulated platforms that promise unrealistic returns.

- Skipping security basics – weak passwords or no two-factor authentication are the fastest way to lose funds.

Buying your first cryptocurrency is not only about the excitement of entering a new digital economy but also about learning discipline, security, and strategy. With the right exchange, proper verification, safe funding methods, and careful storage in wallets, beginners can avoid common mistakes. Understanding fees, transaction types, and risks of volatility allows newcomers to make smarter financial choices. The most important rule is to start small, remain patient, and treat crypto as a long-term investment rather than a quick profit scheme. By following this step-by-step guide, anyone can confidently take their first steps into the world of digital currencies and build a foundation for future growth.

Latest events in politics and global economy at Cryptonews – practical tips on how to act and invest. Read: What is TRC-20 and how to use it in Germany: Complete beginner’s guide with wallets, exchanges