What is P2P trading and why does it remain popular in Germany in 2025

P2P trading (peer-to-peer) is a method of exchanging cryptocurrencies directly between users without the involvement of centralized exchanges or banks. In Germany, this model has been gaining traction because it allows individuals to bypass high banking fees, maintain privacy, and access digital assets without relying on international transfers. In 2025, P2P trading continues to thrive, despite stricter EU regulations, because it fills a gap left by traditional financial institutions. Germans use P2P platforms both to diversify their crypto portfolios and to send cross-border payments quickly. The flexibility of payment methods, from SEPA transfers to PayPal and even cash, makes this system especially attractive. According to market data, up to 20–25% of all crypto transactions in Germany are now facilitated via P2P, as noted by G.business.

The history of P2P trading

The concept of peer-to-peer trading began in 2012 with the launch of LocalBitcoins, which enabled direct Bitcoin transactions worldwide. By 2017, during the ICO boom, P2P activity surged as more people sought alternative ways to buy tokens. The pandemic in 2020 accelerated digital adoption, and P2P became a mainstream option. From 2021 onward, large exchanges such as Binance, Huobi, and OKX integrated P2P marketplaces, making them widely accessible in Europe. In Germany, adoption grew steadily as investors discovered that P2P offered more favorable exchange rates compared to traditional brokers. Even after LocalBitcoins closed in 2023, the P2P sector consolidated, and major exchanges continued offering robust services. Today, P2P is considered one of the pillars of the German crypto ecosystem.

Key development stages:

- 2012 — LocalBitcoins launches.

- 2017 — ICO boom boosts adoption.

- 2020 — COVID-19 increases demand for digital payments.

- 2021 — Binance and OKX add P2P modules.

- 2023–2025 — Regulation tightens, but P2P thrives.

Why P2P trading is popular in Germany in 2025

In Germany, P2P remains attractive because it combines independence with cost efficiency. Traditional banks often impose strict rules on international transfers and apply fees, while P2P offers faster and cheaper alternatives. Many Germans use P2P to exchange euros for stablecoins like USDT, which serve as a hedge against inflation or to facilitate overseas remittances. Privacy is another strong motivator, as P2P gives users more control over their financial data compared to centralized exchanges. For newcomers, P2P is often the easiest entry point into crypto because it does not require advanced trading knowledge. Experienced traders, on the other hand, use P2P to profit from arbitrage opportunities by buying and selling at different rates. This blend of accessibility and profitability ensures that P2P remains an essential part of the German crypto landscape.

Main benefits for German users:

- Avoiding high bank fees on international transfers.

- Full control over the transaction.

- Wide choice of payment methods (SEPA, PayPal, cash, Revolut).

- Often lower commissions compared to exchanges.

- Enhanced privacy and flexibility.

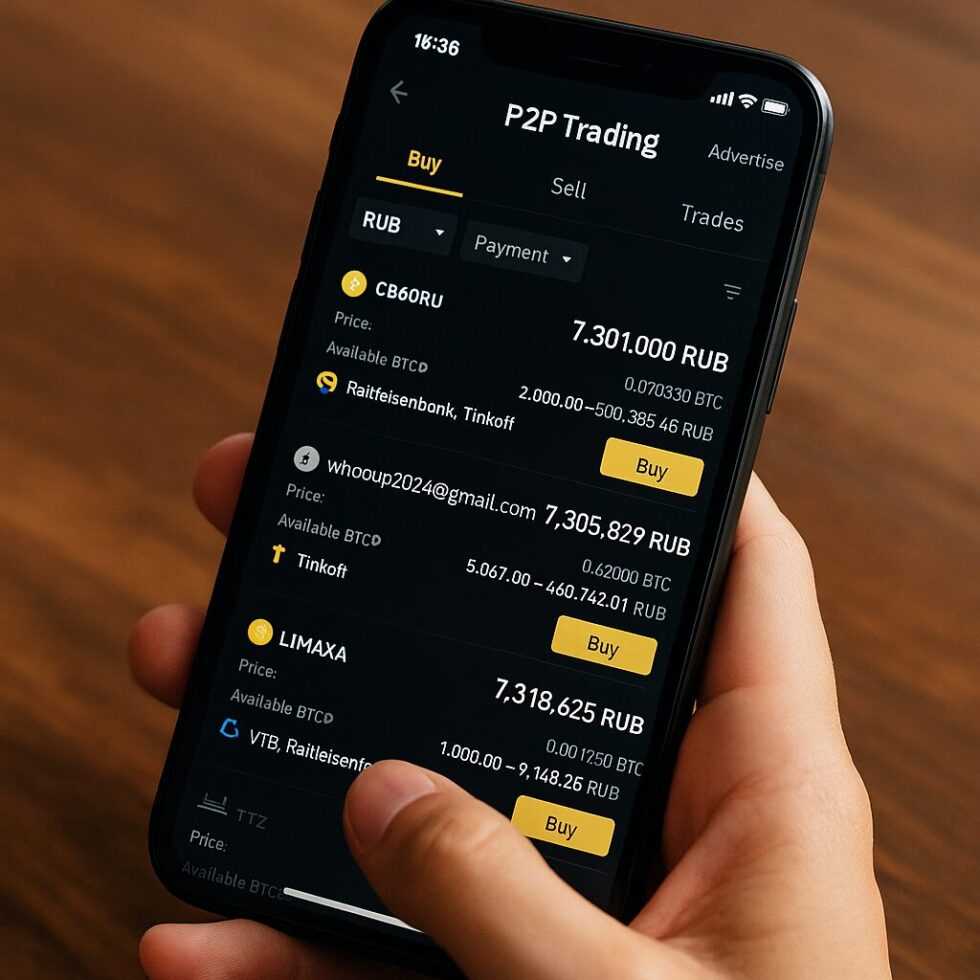

Top P2P platforms used in Germany

In 2025, German users mainly rely on global exchanges that offer integrated P2P marketplaces. Binance P2P, OKX P2P, and Bybit are the leaders, with thousands of daily offers in euros. Paxful, popular in developing regions, is also available but less widely used in Germany due to higher fees. The closure of LocalBitcoins in 2023 left a gap, but most German traders smoothly transitioned to platforms operated by exchanges. These platforms use escrow systems, ensuring that funds are only released once payment is confirmed.

| Platform | Year launched | Availability in Germany | Fees | Key features |

|---|---|---|---|---|

| Binance P2P | 2020 | Yes | 0% | Largest volume, hundreds of SEPA offers |

| OKX P2P | 2021 | Yes | 0% | Multiple payment methods incl. PayPal |

| Bybit P2P | 2022 | Yes | 0% | Fast transactions, strong escrow |

| Paxful | 2015 | Yes | 0.5–1% | Many payment methods, higher cost |

| LocalBitcoins (closed) | 2012 | No (closed in 2023) | — | Historical pioneer |

How P2P trading works in Germany

The process of P2P trading is straightforward. Sellers post offers with their exchange rate, minimum and maximum limits, and accepted payment methods. Buyers select an offer, initiate the trade, and send money directly to the seller via SEPA transfer, PayPal, or another method. The cryptocurrency is locked in escrow until the payment is confirmed. This structure protects both parties and significantly reduces fraud. In Germany, SEPA transfers are the most common option due to speed and low fees, while Blik and Revolut are increasingly used by younger traders. The transaction time varies from minutes to hours depending on the chosen method.

Step-by-step in Germany:

- Select EUR as the fiat currency.

- Filter offers by SEPA, PayPal, or other methods.

- Choose a seller with high rating and positive reviews.

- Transfer funds using the chosen method.

- Seller confirms and crypto is released from escrow.

- Both sides leave feedback to maintain trust.

Risks of P2P trading in Germany

While P2P is legal and widely available, it carries risks. The most common issue is bank scrutiny — German banks sometimes freeze accounts involved in frequent crypto transactions. Fraud remains possible if users trade outside the platform’s escrow system. Price volatility can also affect deals during negotiation. Additionally, the German tax office (Finanzamt) monitors crypto gains, and unreported P2P profits can lead to penalties. Regulatory tightening under MiCA (Markets in Crypto-Assets Regulation) adds further obligations, including reporting large transactions. However, with proper precautions, P2P remains relatively safe.

How German users can stay safe:

- Always use escrow systems of recognized platforms.

- Document all transactions for tax purposes.

- Avoid trading outside the platform.

- Start with small amounts when testing a new partner.

- Be prepared for bank inquiries and provide proof of funds.

Regulations for P2P trading in Germany

Germany is part of the EU, so P2P trading falls under EU-wide MiCA regulations. This means platforms must apply KYC procedures and report suspicious activity. Transactions over €1,000 are closely monitored by financial institutions. For German users, this translates into stricter identity verification, but P2P itself remains legal. Crypto gains from P2P trades are taxed under capital gains law: profits realized within one year are subject to income tax, while gains after a one-year holding period are tax-free. Banks have the right to block transfers linked to unverified crypto activity, which sometimes frustrates users. Still, the government views P2P as part of the regulated financial landscape.

Key regulations in Germany (2025):

- Full KYC verification required.

- Reporting threshold at €1,000 for transactions.

- Profits within one year taxable; tax-free after 1 year.

- Banks can freeze suspicious accounts.

- Compliance with MiCA regulation mandatory.

Comparison: P2P vs centralized exchanges in Germany

For German users, both models are accessible, but they serve different needs. Centralized exchanges are faster and highly liquid, while P2P offers privacy and cost savings. Many traders use both, depending on whether they prioritize speed or independence. The coexistence of both models makes the German crypto market dynamic and resilient.

| Parameter | P2P trading | Centralized exchanges |

|---|---|---|

| Control | Full user control | Exchange controls custody |

| Fees | 0–1% | 0.1–0.5% |

| Payment methods | SEPA, PayPal, Revolut, cash | Only supported methods |

| Speed | Depends on counterpart | Instant |

| Risks | Fraud, bank freezes | Hacks, exchange insolvency |

| Privacy | Higher | Lower |

The future of P2P trading in Germany

Analysts expect P2P to continue growing in Germany despite regulation. As banks impose more checks, users turn to P2P for flexibility. Integration with DeFi is also expected, enabling trades via smart contracts directly from German wallets. Hybrid models, where centralized exchanges host P2P markets, will likely dominate. Insurance for P2P transactions and stronger verification tools will reduce fraud risks. By 2027, Germany could become one of the leading EU hubs for regulated P2P activity.

Future trends in Germany:

- Rising popularity of mobile P2P apps.

- Stricter identity checks under MiCA.

- Expansion of euro-stablecoins for P2P.

- Growth of insured P2P transactions.

- Hybrid models combining P2P and exchanges.

In Germany, P2P trading in 2025 is more than just an alternative to exchanges — it is a financial instrument tailored for flexibility, privacy, and independence. For families sending remittances abroad, for students exploring crypto, or for investors seeking arbitrage opportunities, P2P offers unique benefits. While regulation is becoming stricter, German users continue to rely on P2P to reduce costs and gain autonomy over their funds. As long as the demand for independence in financial transactions exists, P2P trading will remain a crucial component of the German crypto market.

Latest events in politics and global economy at Cryptonews – practical tips on how to act and invest. Read: Why can crypto exchanges block your funds — and how to avoid losses